Analyzing WEEX Exchange: Markets, Liquidity, and Transparency

Introduction

This report provides a comprehensive analysis of WEEX's trading environment, focusing on the following key areas:

Liquidity Depth: Assessment of market depth for major trading pairs on futures markets.

Asset Diversity: Evaluation of the variety and number of assets listed on the platform.

Comparative Analysis: Benchmarking WEEX against other leading cryptocurrency exchanges in terms of liquidity, asset offerings.

For the analysis of markets, we selected the 10 most actively traded coins and tokens. The assets are grouped into:

For the futures market, the analysis focuses on top-of-book liquidity (±0.1%), assessing the available volume at the best bid and ask prices. This approach provides a more accurate representation of immediate execution liquidity in the futures market. The data snapshot took place in May 2025.

Markets Analysis

Liquidity Depth and Slippage Analysis on Futures Markets

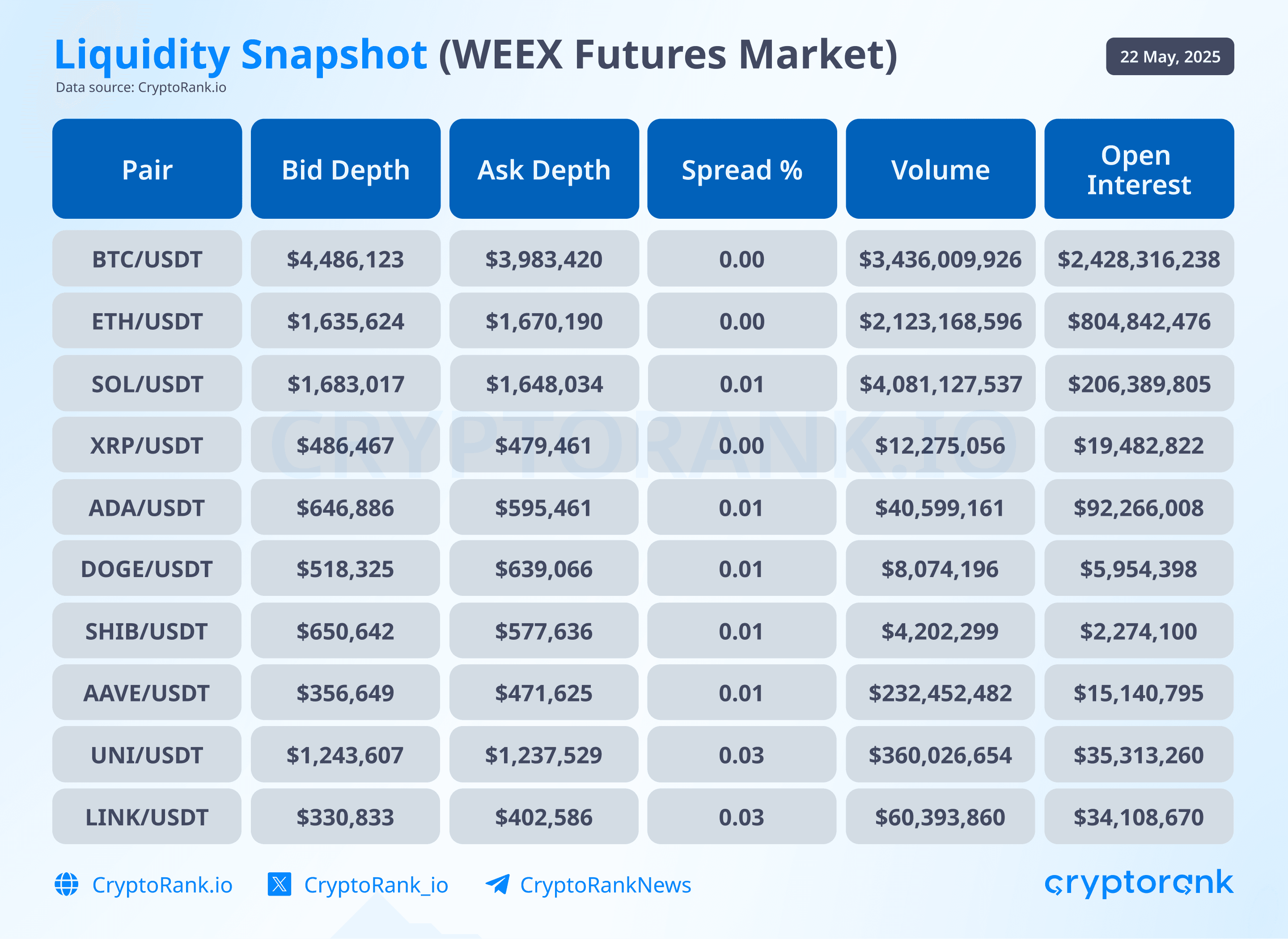

WEEX’s futures markets demonstrate varied liquidity conditions across major and mid-cap assets. Using ±2% depth and spread as proxies for execution quality, the analysis reveals that only a handful of contracts exhibit deep enough order books to reliably handle large trades with minimal slippage.

BTC/USDT remains the most liquid futures pair, with a +2% depth of $4.49M and -2% depth of $3.98M, and a zero spread, which is ideal for large and frequent execution. ETH/USDT also shows solid liquidity, with approximately $1.6M on each side of the book, offering high availability for both retail and institutional traders. SOL/USDT performs similarly, maintaining tight spreads and order book depth exceeding $1.6M, indicating an active derivatives market.

UNI/USDT stands out with depth over $1.2M on each side and a moderate spread of 0.03%, suggesting stable market-making activity. Other pairs like DOGE/USDT, ADA/USDT, and SHIB/USDT maintain depth between $500k and $650k, with spreads holding around 0.01%, making them viable for moderate trading volume but vulnerable to slippage on larger orders.

Contracts such as AAVE/USDT, LINK/USDT, and XRP/USDT display more limited depth, ranging from $330k to $486k, with higher spreads (0.03% for LINK and UNI). These markets are better suited for smaller trades, as larger orders may lead to visible price movement.

Analyzing the Open Interest (OI) relative to trading volume, pairs like BTC/USDT and ETH/USDT indicate a healthy balance, suggesting sustainable liquidity and moderate speculative activity. XRP/USDT's high OI compared to its lower volume points to increased speculative positioning, possibly raising volatility risks.

Overall, WEEX provides high execution quality for top-traded assets like BTC, ETH, and SOL, while offering access to a wide range of altcoin derivatives with moderate to low liquidity. Traders should account for depth limitations and spread sensitivity when planning trade size and strategy across less liquid pairs.

Number of Listed Assets and Presence of Long-tail or Early-listed Tokens.

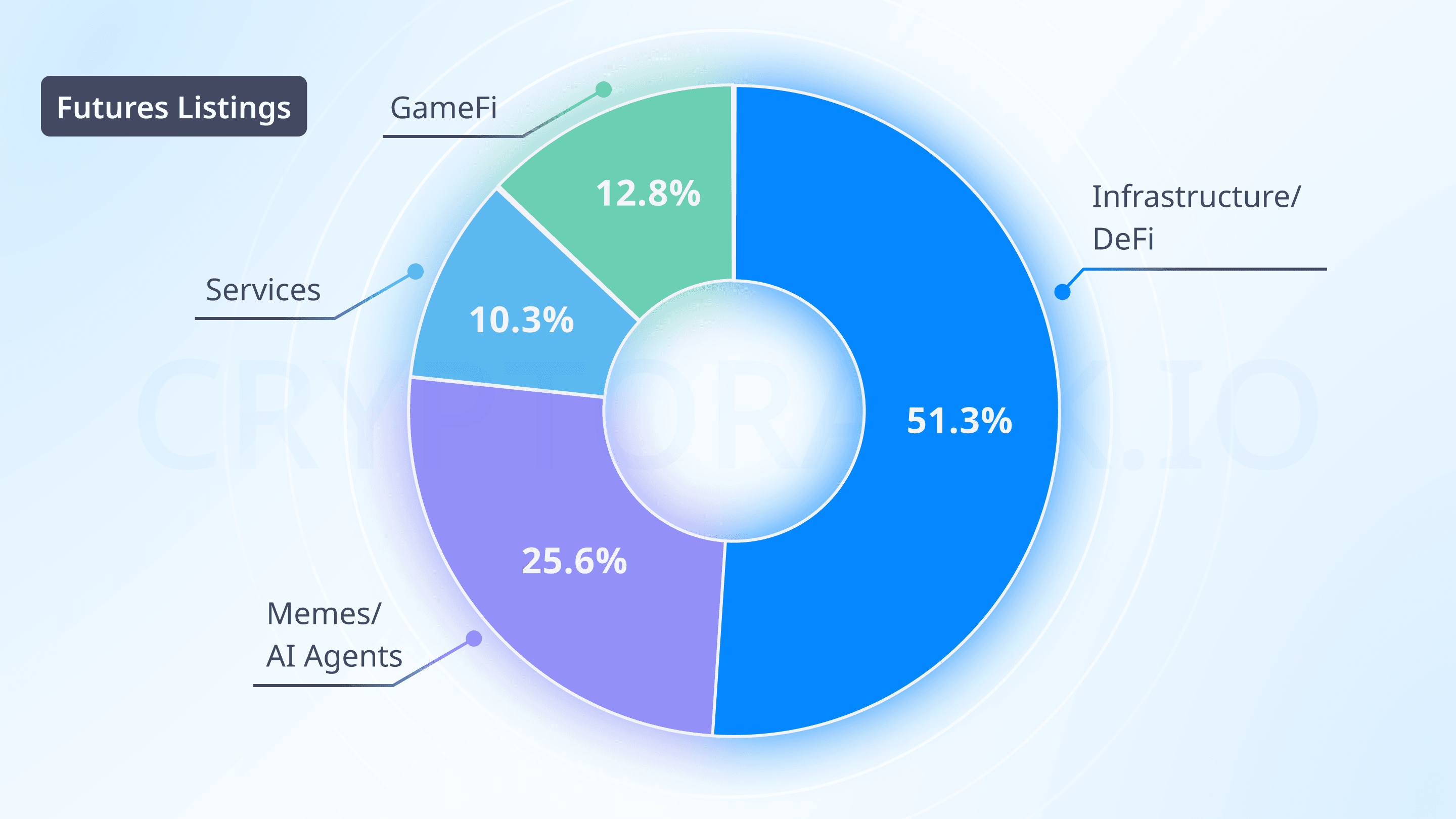

The number of futures trading pairs on WEEX exceeds 700. This highlights the dynamic nature of WEEX's futures offerings, which may appeal to traders seeking diverse derivative instruments. In the last month, WEEX introduced 39 new futures trading pairs.

The futures market prioritizes infrastructure and DeFi tokens (51.3% of new pairs), suggesting a focus on assets with stronger fundamentals or market stability, suitable for leveraged trading. The lower proportion of meme and AI agent tokens (25.6%) in futures indicates a more selective approach, likely to ensure liquidity and reduce risk in derivatives. The presence of GameFi (12.8%) and service-oriented tokens (10.3%) in futures further diversifies offerings, tapping into emerging trends like blockchain gaming.

The high volume of new listings (39 futures pairs in one month) underscores WEEX’s agility in responding to market trends. The emphasis on long-tail tokens in the spot market and early-listed projects across both markets, supported by the WE-Launch program, positions WEEX as a platform for discovering undervalued or emerging assets, appealing to a broad spectrum of traders.

WEEX demonstrates a notable presence of long-tail and early-listed tokens, enhancing its appeal for niche and emerging market traders. Long-tail tokens, defined as less popular or niche cryptocurrencies, are evident from recent listings on WEEX's new token announcements page, such as PUSSFi (PUSS), FARTGIRL, and 42069COIN, listed in April 2025. These tokens, often meme coins or projects with smaller market caps, are typically not widely traded on major exchanges, fitting the long-tail category.

Early-listed tokens, those listed shortly after launch, are supported through WEEX's WE-Launch program, which focuses on airdrops for early-stage crypto projects. The WE-Launch page details historical projects. The program's structure, requiring WXT staking for airdrops, further underscores WEEX's strategy to engage with emerging projects, likely attracting traders interested in growth opportunities.

In summary, WEEX lists around 700 for futures trading, with potential updates suggesting higher futures figures. The exchange actively supports long-tail and early-listed tokens, as evidenced by recent listings and the WE-Launch program, catering to a broad spectrum of trading preferences.

Comparison with Other Exchanges

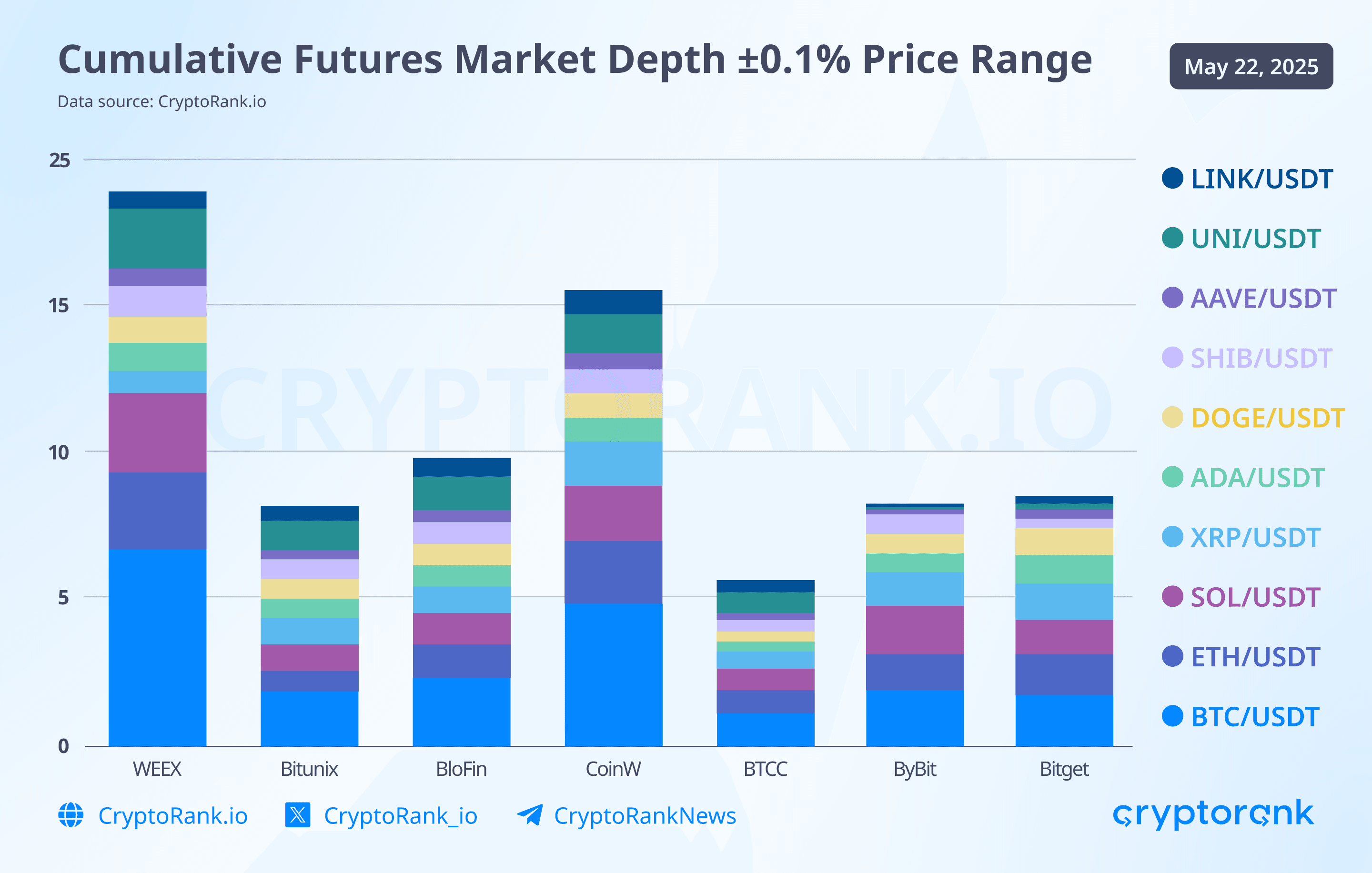

When WEEX is evaluated against other cryptocurrency exchanges, such as Bitunix, CoinW, BloFin, BTCC, Bybit, Bitget, in futures markets, several distinct patterns emerge regarding liquidity depth, execution quality, and asset coverage.

In the futures segment, WEEX offers more than 700 contracts, the largest among the compared platforms. This includes not only high-cap assets but also speculative tokens, AI-themed coins, and meme derivatives. Most competitors support 300–550 pairs, placing WEEX ahead in market exposure and product variety.

WEEX shows strong immediate liquidity on major trading pairs. For the BTC/USDT pair, WEEX offers the highest among all analyzed exchanges at the top of the book, surpassing both institutional platforms like Bitget and Bybit. Similar trends are observed for ETH/USDT and SOL/USDT well above top-of-book levels at competitors such as Bitunix, BloFin, and BTCC.

Bitget and Bybit show relatively low top-of-book volume, These platforms maintain a dense layer of small, rapidly replenished limit orders close to the mid-price. While this enables high-frequency trading and nearly instant execution for small orders, it means actual top-of-book depth appears limited in snapshots, even though liquidity increases significantly at slightly deeper levels such as within 0.1% of the mid-price. At these depths, WEEX and other mid-tier exchanges currently cannot compete with the scale and algorithmic liquidity density of Bybit and Bitget.

Liquidity on futures for pairs like SOL/USDT, ETH/USDT, and DOGE/USDT is sufficient for moderate volume trading. Notably, spreads on WEEX remain exceptionally low (0.00–0.01%), even on mid- and low-cap contracts, offering reliable execution conditions.

While it does not yet match the institutional-level liquidity of Bybit or Bitget on core futures pairs, WEEX remains highly competitive in spread efficiency and continues to build market depth. For traders focused on variety, early access, and efficient execution in liquid majors, WEEX represents a uniquely positioned alternative in the current exchange landscape.

Security and Transparency

WEEX maintains a strict 1:1 reserve ratio, ensuring that all user assets are fully backed. The platform provides a Proof of Reserves system, allowing users to verify that their holdings are matched by equivalent reserves. This system enhances trust and transparency by demonstrating the platform's solvency.

To safeguard user assets, WEEX has established a 1,000 BTC Protection Fund, serving as an emergency reserve to cover potential losses. The platform employs advanced security measures, including two-factor authentication (2FA), cold storage solutions, and regular security audits. WEEX has also undergone independent security assessments, affirming its commitment to maintaining high-security standards.

Conclusion

WEEX presents itself as a fast-evolving exchange with a strong balance between innovation, asset diversity, and user-focused infrastructure. WEEX demonstrates strengths that position it as a compelling alternative for retail and mid-size traders.

WEEX doesn’t yet match the institutional-grade depth and volume of the largest exchanges, but it competes effectively in fee efficiency, asset breadth, and execution quality on major pairs. Its aggressive listing approach and focus on emerging sectors give it an edge for users seeking fast access to new market opportunities.

For retail traders, WEEX offers an appealing mix of low fees, wide asset selection, and solid execution on leading pairs. Its support for long-tail tokens and early-stage projects makes it especially attractive to users following trends and new narratives in crypto.

In summary, WEEX is a well-rounded exchange for users who prioritize early access, cost efficiency, and diverse exposure, while accepting the trade-offs of moderate depth in less mainstream markets.

Join Us on the Next WEEX Adventure

This year, WEEX measured the world with our footsteps and earned trust through action. Whether you’re a trader, developer, or industry observer, we look forward to meeting you at our next stop.

Be Part of What’s Next! Register Now

Follow WEEX on social media:

· Instagram: @WEEX_Exchange

· X: @WEEX_Official

· Tiktok: @weex_global

· Youtube: @WEEX_Global

· Telegram: WeexGlobal Group

You may also like

Insider Whale Acquires Additional 22,000 ETH

Key Takeaways The “1011 Insider Whale” has added another 22,000 ETH to their holdings. The ETH purchase is…

Dormant Ethereum Whale Transfers 50,000 ETH to Gemini, Market Reacts

Key Takeaways A significant dormant Ethereum whale transferred 50,000 ETH, valued at approximately $145 million, to the Gemini…

XRP Price Shows Potential for Rebound as Market Conditions Shift

Key Takeaways XRP’s price is under pressure but shows signs of a potential rebound driven by technical indicators…

Aperture Finance Faces $17 Million Loss in Blockchain Security Breach

Key Takeaways Aperture Finance suffered a substantial security breach, resulting in the loss of approximately $17 million across…

Justin Sun Boosts River Token with $8 Million Investment

Key Takeaways Justin Sun has invested $8 million into River Protocol, significantly impacting the token’s performance. Following the…

DODO Experiences Significant 24-Hour Growth Due to Strategic Developments

Key Takeaways DODO’s price has seen a 25.46% increase, reaching $0.02 within the last 24 hours. A strategic…

Tezos’ Tallinn Upgrade Now Live, Reduces Block Times to 6 Seconds

Key Takeaways The Tallinn protocol update is Tezos’ 20th major upgrade since its inception, optimizing multiple aspects of…

Crypto Takeaways from Davos: When Politics and Finances Collide

Key Takeaways Trump’s Geopolitical Crypto Push: U.S. President Trump emphasized the urgency of crypto regulation as a geopolitical…

Restaking Delivers Risk and Minimal Real Value

Key Takeaways Restaking in decentralized finance appears promising but poses substantial risks due to its layered leveraging strategy.…

Could Europe Sell US Debt if a Greenland Deal Doesn’t Come Through?

Key Takeaways The geopolitical tensions involving Greenland could lead Europe to consider offloading US debt as a strategic…

Japan Considers a New Framework Allowing Crypto ETFs by 2028

Key Takeaways Japan’s regulators are contemplating changes to allow cryptocurrency exchange-traded funds (ETFs) by 2028, marking a significant…

![[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards](https://images-cms.weex.com/medium_Win_a_Share_of_100_000_in_Rewards_75e69c3539.PNG)

[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards

Discover how WEEX VIP traders participate in the VIP Spot Sprint and compete for a share of the $100,000 rewards pool. Clear rules, performance-based rankings.

ETH Ecosystem Month: A $1.5 Million Trading Opportunity Focused on Ethereum Assets

Explore ETH trading opportunities on WEEX with ETH Ecosystem Month. A $1.5M campaign covering ETH spot trading, ETH futures rewards, leaderboards, and referral incentives across the Ethereum ecosystem.

Trade Finance: Unleashing Blockchain’s Most Potent Opportunity

Key Takeaways Blockchain technology has the potential to revolutionize the $9.7-trillion global trade finance market by addressing its…

Crypto’s Decentralization Dream Falters at Interoperability

Key Takeaways The promise of decentralization in the crypto industry is hindered by centralized intermediaries managing interoperability between…

New SEC Submissions Discuss Self-Custody and DeFi Regulation

Key Takeaways Recent submissions to the SEC tackle the regulation of self-custody rights and decentralized finance (DeFi) markets.…

Pendle Announces Token Upgrade as Its DeFi Yield Platform Scales

Key Takeaways Pendle has announced a significant upgrade to its native token, introducing sPENDLE to enhance liquidity and…

Pendle Announces Token Upgrade as Its DeFi Yield Platform Evolves

Key Takeaways Pendle introduces sPENDLE to enhance liquidity and diversify revenue. Boros platform enhances onchain rates trading, emphasizing…

Insider Whale Acquires Additional 22,000 ETH

Key Takeaways The “1011 Insider Whale” has added another 22,000 ETH to their holdings. The ETH purchase is…

Dormant Ethereum Whale Transfers 50,000 ETH to Gemini, Market Reacts

Key Takeaways A significant dormant Ethereum whale transferred 50,000 ETH, valued at approximately $145 million, to the Gemini…

XRP Price Shows Potential for Rebound as Market Conditions Shift

Key Takeaways XRP’s price is under pressure but shows signs of a potential rebound driven by technical indicators…

Aperture Finance Faces $17 Million Loss in Blockchain Security Breach

Key Takeaways Aperture Finance suffered a substantial security breach, resulting in the loss of approximately $17 million across…

Justin Sun Boosts River Token with $8 Million Investment

Key Takeaways Justin Sun has invested $8 million into River Protocol, significantly impacting the token’s performance. Following the…

DODO Experiences Significant 24-Hour Growth Due to Strategic Developments

Key Takeaways DODO’s price has seen a 25.46% increase, reaching $0.02 within the last 24 hours. A strategic…