Bitcoin’s $20K Strike Options: Betting on Market Volatility

Key Takeaways

- The $20,000 strike put option for June 2026 has garnered significant interest, reaching over $191 million in notional open interest.

- Deep out-of-the-money options represent bets on volatility rather than direct price direction.

- Traders are using long-dated options for volatility positioning, not for hedging price movement.

- The current options market shows a generally bearish sentiment, with BTC puts trading at a premium over calls.

- Institutional involvement and sophisticated strategies like call overwriting are shaping the crypto options scene.

WEEX Crypto News, 2025-12-09 09:27:07

The Rise of Deep Out-of-the-Money Bitcoin Options

In the evolving landscape of cryptocurrency trading, a peculiar trend is emerging among Bitcoin options traders. Deep out-of-the-money (OTM) options, particularly the $20,000 strike put for June 2026, are capturing the attention of savvy investors. Contrary to initial impressions, these options are less about directional price movement and more about capitalizing on potential volatility explosions, akin to acquiring a “lottery ticket” on future market turbulence.

The burgeoning interest showcased by the over $191 million in notional open interest for the $20,000 strike option reflects a strategic positioning that opts to leverage anticipated volatility rather than hedge against it. This nuanced approach marks a departure from traditional risk mitigation strategies, with traders embracing these long-dated options as a low-cost method to bet on price fluctuations.

Volatility Over Direction: A Strategic Shift

Sidrah Fariq, the Global Head of Retail at Deribit, clarifies the strategic intent behind this trading maneuver. According to Fariq, such deep OTM options, like the $20,000 put or the $230,000 call, are too removed from the current spot price, hovering around $90,500, to be effective as routine hedges. Instead, they serve as instruments of volatility speculation.

This approach underscores the broader market sentiment where hedging strategies are pivoting toward volatility anticipation rather than simple directional bets. By leveraging long-dated options, traders can realign their portfolios to adjust tail risk and shield against unpredictable market swings.

Broader Market Sentiments and Institutional Influence

Options trading has become a sophisticated domain where institutions and substantial stakeholders, often referred to as “whales,” navigate the waters with a high degree of strategy. These entities engage in what can be likened to three-dimensional chess, balancing risk across multiple dimensions: price direction, time decay, and volatility fluctuations. In this intricate setup, a bearish outlook has taken precedence, as evidenced by the premium trading of BTC puts relative to calls across various tenors.

The adoption of strategies like call overwriting further supplements this bearish demeanor. Essentially, these tactics aim to enhance yield by selling calls against existing spot holdings. Notably, institutions have particularly influenced the options market tied to instruments such as BlackRock’s IBIT ETF, accentuating this trend of complexity and calculated risk moderation.

An Insight into the Crypto Derivatives Landscape

Options, by their nature, offer the right—not the obligation—to transact the underlying asset at a pre-set future price. This dual functionality allows calls, which provide purchase rights (seen as bullish), and puts, which grant selling rights (interpreted as bearish). In the context of Bitcoin, the surge in demand for these OTM options highlights the allure of potential asymmetrical payoffs. Should extreme price volatility ensue, both calls and puts can offer lucrative returns.

However, this strategy is not without its downside. A stagnant Bitcoin market would render these speculative instruments quickly devalued. Consequently, traders employing this strategy must exhibit a high tolerance for risk and an underlying belief in impending dramatic price movements.

More Than Just Bitcoin: Broader Crypto Ecosystem Movements

While Bitcoin takes the spotlight, it’s notable that other cryptocurrencies are playing critical roles in the broader financial ecosystem. For instance, projects like Dogecoin, with its recent token consolidation trends and active address upticks, underscore the dynamic interactions within the market. Similarly, analysis of XRP and Solana reflects differing narratives yet similarly volatile market conditions.

This shifting terrain illustrates a complex interplay among various digital currencies, each influencing the market in unique ways. Traders and investors are continually adapting their approaches, considering both macroeconomic indicators and sector-specific developments.

FAQs

What is a deep out-of-the-money (OTM) option?

Deep out-of-the-money (OTM) options are options with strike prices significantly removed from the current market price of the underlying asset. For example, a $20,000 Bitcoin put option is considered deep OTM when the current price is around $90,000.

Why do traders invest in deep OTM options?

Traders invest in deep OTM options to speculate on large market movements and volatility. Although risky, these options are cheaper and can yield high returns if the market experiences significant price swings in either direction.

What does the $20,000 Bitcoin put option signify?

The $20,000 Bitcoin put option suggests a bet on extreme market volatility rather than a prediction that Bitcoin will drop to $20,000. These positions are often adopted by traders who anticipate drastic movement and want to capitalize on potential volatility spikes.

How does the options market reflect Bitcoin’s current sentiment?

The options market currently reveals a bearish sentiment, with Bitcoin puts generally trading at a premium over calls. This trend is driven by persistent market strategies like call overwriting, where calls are sold to augment income from existing holdings.

Can holding both puts and calls be advantageous?

Yes, holding both puts and calls allows traders to benefit from substantial market volatility. Regardless of price direction, asymmetric payoffs can be realized if Bitcoin undergoes dramatic price shifts, making it a strategy for those betting on volatility rather than price certainty.

In conclusion, the intricate world of Bitcoin options trading highlights an evolved and forward-thinking market approach. Rather than betting on straightforward price movements, traders utilize these financial instruments to position for volatility, reflecting a robust and adaptive market environment. As Bitcoin’s ecosystem continues to mature, so too do the varied and complex strategies employed by its participants, painting a picture of a financial landscape that is both unpredictable and profoundly exciting.

You may also like

Is AI Taking Over Everything as Cryptography Wasn't Designed for Humans?

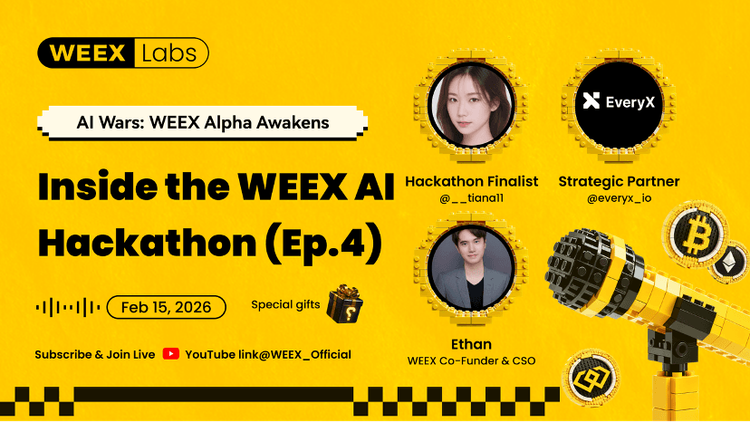

WEEX AI Trading Hackathon: 3 Key Insights on the Future of AI Trading & Prediction Markets

Dive into the key takeaways from the WEEX AI Trading Hackathon AMA. Get 3 critical insights from platform builders, prediction market experts, and winning traders on the future of AI trading, how to trade social sentiment, and why human-AI collaboration is the ultimate edge.

Beyond the Battle: PS5 Prizes, 1,000 USDT Giveaways & Key WEEX AI Trading Insights from Istanbul

Get key insights from the frontline of AI trading: Analysis of a live showdown in Istanbul reveals when human intuition beats AI, and where algorithms dominate. Learn the future of collaborative trading.

2026 Spring Festival: Why Did Tech Giants Splurge 4.5 Billion on Insane AI Payment Subsidies?

Bloomberg: How Did a16z Become a Key Player in US AI Policy?

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Is AI Taking Over Everything as Cryptography Wasn't Designed for Humans?

WEEX AI Trading Hackathon: 3 Key Insights on the Future of AI Trading & Prediction Markets

Dive into the key takeaways from the WEEX AI Trading Hackathon AMA. Get 3 critical insights from platform builders, prediction market experts, and winning traders on the future of AI trading, how to trade social sentiment, and why human-AI collaboration is the ultimate edge.

Beyond the Battle: PS5 Prizes, 1,000 USDT Giveaways & Key WEEX AI Trading Insights from Istanbul

Get key insights from the frontline of AI trading: Analysis of a live showdown in Istanbul reveals when human intuition beats AI, and where algorithms dominate. Learn the future of collaborative trading.