Circle’s Strategic Expansion: USDC’s Foray into the Middle East with Abu Dhabi License

Key Takeaways

- Circle has acquired a significant Financial Services Permission license from Abu Dhabi Global Market, allowing operation as a Money Services Provider in the United Arab Emirates.

- This move represents Circle’s commitment to expanding its USDC stablecoin offerings across international markets, reinforcing UAE’s status as a hub for digital assets.

- Dr. Saeeda Jaffar, previously with Visa, joins Circle to lead its operations within the regions of the Middle East and Africa.

- With this strategic license, Circle aims to create robust pathways for business payments and settlements using USDC, as stablecoins continue to integrate into global financial systems.

WEEX Crypto News, 2025-12-09 09:27:07

A New Dawn for Digital Currencies in the UAE

Amid the burgeoning world of cryptocurrencies, Circle has marked a pivotal moment with the acquisition of a Financial Services Permission (FSP) license from the Abu Dhabi Global Market (ADGM). This strategic license enables Circle to operate as a Money Services Provider in the UAE, thus cementing its presence in one of the leading regulated crypto environments worldwide.

For Circle, the stablecoin issuer known for its $78 billion USDC, this acquisition represents not just an opportunity for further financial engagements but a strategic positioning in a region increasingly recognized as a formidable digital assets hub. With this endorsement by the ADGM’s Financial Services Regulatory Authority (FSRA), Circle is now poised to pioneer various financial services, including business payments and settlements using its USDC stablecoin, within the UAE.

This broad regulatory embrace by UAE authorities comes as part of a larger narrative. The UAE is swiftly becoming a global nucleus for regulated digital assets—an ambition further solidified by similar licenses previously extended to industry giants such as Binance. This environment reflects a growing recognition of cryptocurrencies’ integral role within modern financial ecosystems, particularly amid growing trends for decentralized finance solutions.

Circle’s Vision and Leadership in the Region

One of the cornerstones of Circle’s strategy involves expanding its leadership team to effectively manage operations within this new territory. Enter Dr. Saeeda Jaffar, previously an executive at Visa, who steps into the role of managing director for the Middle East and Africa region. Her appointment underscores Circle’s commitment to leveraging global financial expertise to navigate and thrive within the region’s complex financial landscapes.

Dr. Jaffar’s expertise signifies more than just an executive decision; it catalyzes Circle’s vision of embracing multicultural financial environments, understanding regional market dynamics, and developing tailored financial solutions that resonate with local businesses and consumers. Her experience with a global payments leader equips Circle with unique insights and navigational strategies crucial for capitalizing on the emergent market potential.

The Broader Context of Circle’s License Acquisition

The approval of Circle’s license can be seen as a crucial move within the wider context of booming stablecoin utilization worldwide. These digital currencies are increasingly becoming integral in facilitating seamless cross-border transactions, especially in areas where traditional banking channels may prove inconsistent or economically prohibitive.

Stablecoins, such as USDC, provide the much-needed stability in the volatile crypto market, anchoring their value in more stable assets or entities. Their rise in usage underscores their potential to transform financial operations, offering fast, efficient, and secure methods of payment that traditional financial systems struggle to match.

As more regulatory frameworks begin to embrace and formalize the role of digital assets, entities like Circle can harness these new pathways to scale their operations effectively. The UAE’s status as a burgeoning hub for such digital innovations provides an ideal testing ground for proving these concepts, with an eye towards broader, global adoption.

Regulatory Landscape: UAE’s Model of Digital Asset Governance

The UAE’s proactive stance on developing a regulated environment for digital assets reflects a commitment to embracing the digital transformation of finance. By welcoming crypto entities like Circle with comprehensive licensing protocols, the UAE not only attracts foreign investment but also positions itself as a leader in the fintech and digital space.

The licensing of Circle follows a wider trend of major players like Binance achieving similar approvals, further affirming the UAE’s status as a legitimate haven for digital asset businesses looking for regulatory certainty and business-friendly environments.

In recognizing the potential of stablecoins to act as conduits for financial inclusion, the UAE’s meticulous approach to regulation ensures that digital currencies can be integrated into larger economic frameworks responsibly. The government’s foresight in this space might become a model for future regulatory structures globally, which seek to balance innovation with consumer protection.

Implications for Global Stablecoin Ecosystem

The integration of stablecoins into the larger financial ecosystem holds vast potential. They represent a bridge between crypto and traditional finance, often utilized for trading, lending, remittances, and even securing value against inflation—functions traditionally covered by fiat currency.

Circle’s acquisition of the ADGM license not only affirms the company’s vision of expanding USDC’s use cases but also reinforces the narrative around stablecoins becoming pivotal in shaping the future of international finance. Their ability to provide reliable, transparent, and instantaneous transactions opens a plethora of opportunities for businesses and consumers alike.

In conjunction with the rising acceptance of decentralized finance (DeFi) capabilities, stablecoins can be expected to play an even more significant role in developing robust financial products that address gaps left unfilled by conventional banking systems. Circle’s entrenched position in the UAE could set a precedent for how such entities navigate regulatory environments worldwide to unlock these potentials.

Looking Ahead: Circle’s Next Steps

With the regulatory green light from the ADGM, Circle stands at a pivotal point, its roadmap likely to feature the enhancement of cross-border transactions, the development of region-specific financial solutions, and initiatives to drive local economic participation in the global digital economy.

The company’s strategy will likely include partnerships with local businesses and financial institutions to integrate USDC into a multitude of financial applications—from facilitating everyday payments to powering sophisticated financial instruments. Such collaboration will not only make Circle a crucial player in the UAE’s digital transformation but could also serve as a roadmap for other markets looking to execute similar strategies.

Embracing this dynamic sphere will require agility and adaptability as regulatory frameworks further evolve. However, Circle’s proactive engagement with institutions like ADGM reflects its commitment to navigating these changes deftly, ensuring that its products and services remain both compliant and strategically beneficial.

Conclusion

Circle’s acquisition of the ADGM license marks a significant milestone in the company’s journey to embed USDC into the global financial fabric. As the digital currency ecosystem matures, Circle’s strategic positioning in the Middle East, led by a seasoned executive, exemplifies a tangible step towards realizing a future where digital currencies meet traditional financial systems in harmonious synergy.

The implications extend beyond business prosperity; they signify a forward leap for digital currencies’ role within mainstream finance, potentially guiding other regions in adopting a balanced regulatory approach that fosters innovation while safeguarding economic stakeholders.

In sum, Circle’s strategic expansion and the acquisition of regulatory approval not only solidify its footprint in the Middle East but also forecast a broader acceptance of stablecoins as pillars of modern financial frameworks. The company’s vision to revolutionize finance through technology puts it at the forefront of bridging traditional financial systems with emerging digital paradigms, ensuring its place as a leader in the next chapter of global finance.

Frequently Asked Questions (FAQs)

What is the significance of Circle obtaining the ADGM license?

The acquisition of a Financial Services Permission license from the Abu Dhabi Global Market is pivotal as it allows Circle to formally operate as a Money Services Provider in the UAE, thus reinforcing its presence in a major global hub for digital assets.

How does Circle’s strategy align with the UAE’s broader fintech goals?

Circle’s strategy complements the UAE’s ambition to become a leader in digital finance by integrating stablecoins like USDC into the financial system, which can facilitate efficient, secure cross-border transactions and boost financial inclusion.

Who is Dr. Saeeda Jaffar and what role does she play in Circle’s strategy?

Dr. Saeeda Jaffar, a former executive at Visa, has been appointed as the managing director for the Middle East and Africa. Her role is crucial in steering Circle’s operations in the region, leveraging her expertise to guide Circle in regional market dynamics.

What impact could this license have on the global stablecoin ecosystem?

By using this license to expand USDC’s applications, Circle is poised to revolutionize cross-border payments and settlements, showcasing the broader potential of stablecoins in global finance and setting a precedence for similar initiatives.

How might Circle’s presence in the UAE influence other global markets?

Circle’s successful integration in the UAE could act as a blueprint for expanding into other global markets, demonstrating the viability and benefits of digital currencies under a well-defined regulatory framework.

You may also like

Is AI Taking Over Everything as Cryptography Wasn't Designed for Humans?

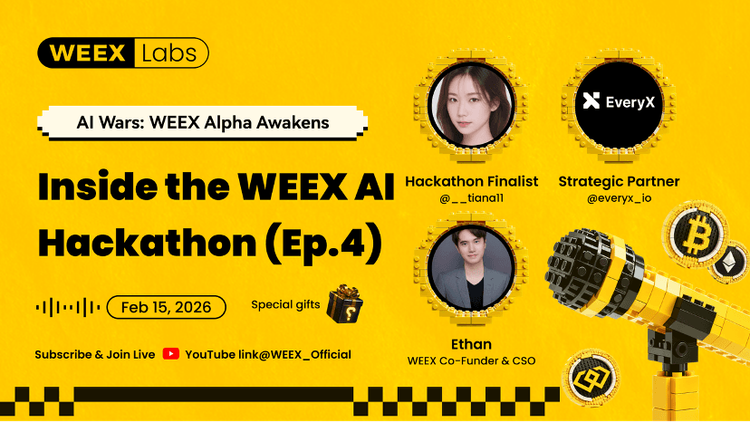

WEEX AI Trading Hackathon: 3 Key Insights on the Future of AI Trading & Prediction Markets

Dive into the key takeaways from the WEEX AI Trading Hackathon AMA. Get 3 critical insights from platform builders, prediction market experts, and winning traders on the future of AI trading, how to trade social sentiment, and why human-AI collaboration is the ultimate edge.

Beyond the Battle: PS5 Prizes, 1,000 USDT Giveaways & Key WEEX AI Trading Insights from Istanbul

Get key insights from the frontline of AI trading: Analysis of a live showdown in Istanbul reveals when human intuition beats AI, and where algorithms dominate. Learn the future of collaborative trading.

2026 Spring Festival: Why Did Tech Giants Splurge 4.5 Billion on Insane AI Payment Subsidies?

Bloomberg: How Did a16z Become a Key Player in US AI Policy?

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Is AI Taking Over Everything as Cryptography Wasn't Designed for Humans?

WEEX AI Trading Hackathon: 3 Key Insights on the Future of AI Trading & Prediction Markets

Dive into the key takeaways from the WEEX AI Trading Hackathon AMA. Get 3 critical insights from platform builders, prediction market experts, and winning traders on the future of AI trading, how to trade social sentiment, and why human-AI collaboration is the ultimate edge.

Beyond the Battle: PS5 Prizes, 1,000 USDT Giveaways & Key WEEX AI Trading Insights from Istanbul

Get key insights from the frontline of AI trading: Analysis of a live showdown in Istanbul reveals when human intuition beats AI, and where algorithms dominate. Learn the future of collaborative trading.