CoreWeave’s Ambitious AI Expansion and $2 Billion Convertible Note Offering

Key Takeaways

- CoreWeave aims to raise $2 billion through convertible senior notes to bolster its AI infrastructure.

- The company is using capped-call transactions to minimize potential shareholder dilution.

- CoreWeave’s history includes a shift from crypto mining to cloud and AI services.

- A failed $9 billion acquisition of Core Scientific highlighted strategic ambitions for additional power capacity.

WEEX Crypto News, 2025-12-09 09:17:01

Introduction to CoreWeave’s Strategic Funding

In a bold step to expand its capabilities in the artificial intelligence (AI) sector, CoreWeave, an AI infrastructure provider, recently announced plans for a significant $2 billion convertible note offering. This financial strategy, centered around convertible senior notes due by 2031, is designed to support the company’s growth ambitions while carefully managing shareholder dilution. The funds raised are earmarked for general corporate purposes and strategic financial maneuvers known as capped-call transactions, which provide a hedge against potential future equity dilution.

The Strategy Behind Convertible Notes

Convertible notes are essentially financial tools that allow holders the option to convert their debt into a certain amount of equity, usually at a predetermined rate. CoreWeave’s decision to include a provision allowing purchasers to buy an additional $300 million underscores its aim to attract robust investment and maintain financial flexibility. The notes can be settled in various ways—cash, equity, or a combination of both—depending on the company’s discretion. This flexibility ensures CoreWeave can maintain an optimal balance between growth and shareholder interests.

Historical Context and Evolution of CoreWeave

Founded in 2017 as Atlantic Crypto, CoreWeave’s initial endeavors focused on utilizing graphics processing units (GPUs) for Ether mining. However, as the cryptocurrency market faced volatility, the company strategically pivoted in 2019, shifting its focus towards high-performance computing services and later emphasizing AI workloads. By refocusing its technical infrastructure toward AI, CoreWeave successfully established a robust network of data centers tailored for next-generation computing tasks. These centers form the backbone of its current operations, with the company now managing over 33 specialized facilities.

The funds from the convertible notes are poised to strengthen CoreWeave’s existing infrastructure, though the company has yet to confirm if this will include expanding its facility footprint. As such, the decision to leverage convertible notes highlights its commitment to maintaining its trajectory in augmenting AI capabilities without spreading its resources too thin.

Capped-Call Transactions: A Strategic Step

To safeguard against the potential conversion impact of notes into equity, CoreWeave is engaging in capped-call transactions. These transactions serve as a hedge, effectively increasing the price at which notes can be converted into shares. This financial maneuver not only protects existing shareholders by limiting dilution but also preserves vital financial agility, allowing the company to maneuver future opportunities and challenges effectively.

The Unsuccessful Pursuit of Core Scientific

An intriguing chapter in CoreWeave’s recent history involves its attempted acquisition of Core Scientific, a major entity in the Bitcoin mining space. CoreWeave made an aggressive $9 billion bid to acquire Core Scientific, enticed by the prospect of securing approximately 1.3 gigawatts of power capacity—an asset crucial for any expansive AI and computing ambition. An acquisition of this scale would have significantly bolstered CoreWeave’s capacity to manage intensive AI and cloud computing workloads.

However, this audacious acquisition proposal was ultimately thwarted when Core Scientific’s shareholders voted against the deal. This rejection culminated after a year-long pursuit beginning in June 2024, compounded by an increase in Core Scientific’s stock prices, which made the final offer cost-prohibitive. Nevertheless, the attempt underscores CoreWeave’s potential strategic interests in aligning its capabilities with the growing AI infrastructure landscape and possibly venturing back into aspects of crypto infrastructure.

The Road Ahead: CoreWeave’s Position in AI

The nature of CoreWeave’s undertakings reflects its deep-seated ambition to remain at the forefront of AI infrastructure. By strategically leveraging financial tools like convertible notes and engaging in potential acquisition opportunities, CoreWeave positions itself within a rapidly evolving technological landscape. AI and cloud computing are vast fields with an insatiable appetite for increased computational power and efficiency—areas where CoreWeave aims to excel.

FAQs

What are convertible senior notes?

Convertible senior notes are a type of debt instrument that a company can issue to finance operations. These notes can typically be converted into equity shares at a later stage, subject to certain terms and conditions.

How do capped-call transactions benefit CoreWeave?

Capped-call transactions allow CoreWeave to set a higher effective conversion price for its convertible notes, which mitigates the dilution effect on existing shares if the notes are converted into equity.

Why did CoreWeave pursue Core Scientific?

CoreWeave pursued Core Scientific to secure significant power capacity that could enhance its capabilities in AI, cloud computing, and other GPU-intensive applications, aligning with its expansion strategy.

How did CoreWeave transition from crypto mining to AI infrastructure?

Initially focused on GPU mining for cryptocurrencies, CoreWeave pivoted to cloud and AI services as the crypto market’s uncertainties increased. This strategic pivot allowed the company to refocus resources on developing infrastructures that cater to the burgeoning AI market.

What does CoreWeave’s future look like in the realm of AI?

CoreWeave is poised to continue its expansion in AI infrastructure, leveraging its strategic financial decisions and potential acquisition goals to influence its standing and offer superior high-performance computing solutions in AI and cloud computing sectors.

You may also like

Is AI Taking Over Everything as Cryptography Wasn't Designed for Humans?

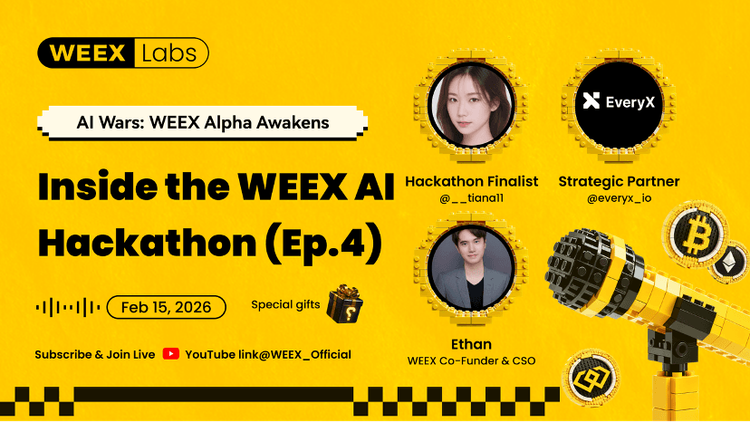

WEEX AI Trading Hackathon: 3 Key Insights on the Future of AI Trading & Prediction Markets

Dive into the key takeaways from the WEEX AI Trading Hackathon AMA. Get 3 critical insights from platform builders, prediction market experts, and winning traders on the future of AI trading, how to trade social sentiment, and why human-AI collaboration is the ultimate edge.

Beyond the Battle: PS5 Prizes, 1,000 USDT Giveaways & Key WEEX AI Trading Insights from Istanbul

Get key insights from the frontline of AI trading: Analysis of a live showdown in Istanbul reveals when human intuition beats AI, and where algorithms dominate. Learn the future of collaborative trading.

2026 Spring Festival: Why Did Tech Giants Splurge 4.5 Billion on Insane AI Payment Subsidies?

Bloomberg: How Did a16z Become a Key Player in US AI Policy?

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Is AI Taking Over Everything as Cryptography Wasn't Designed for Humans?

WEEX AI Trading Hackathon: 3 Key Insights on the Future of AI Trading & Prediction Markets

Dive into the key takeaways from the WEEX AI Trading Hackathon AMA. Get 3 critical insights from platform builders, prediction market experts, and winning traders on the future of AI trading, how to trade social sentiment, and why human-AI collaboration is the ultimate edge.

Beyond the Battle: PS5 Prizes, 1,000 USDT Giveaways & Key WEEX AI Trading Insights from Istanbul

Get key insights from the frontline of AI trading: Analysis of a live showdown in Istanbul reveals when human intuition beats AI, and where algorithms dominate. Learn the future of collaborative trading.