From 30% Profit to Losing It All: Beware of the "Greed Trap" in the Crypto Bear Market

Original Article Title: How to survive a bear market in DeFi market neutral

Original Article Author: Santisa, Crypto KOL

Original Article Translation: Felix, PANews

Before delving into the content of this article, let's first consider the following story (or perhaps reality).

An "endless" tariff list is announced. Subsequently, the market crashes, and meme coins collapse.

Your original low-risk "mining farm" yield drops from 30% to nearly Treasury bill levels.

This is unacceptable to you. You had planned to retire with $300,000, earning $90,000 annually from "mining." Therefore, the yield had to be high.

So, you start exploring down the risk curve, chasing an imagined level of yield as if the market would favor you.

You swapped blue-chip projects for unknown new projects; you increased your yield by deploying assets to high-risk new fixed-term protocols or AMMs. You started feeling smug.

Weeks later, you begin to question why you had been so risk-averse in the first place. It was clearly a "safe and reliable" way to make money.

Then, a surprise comes.

The ultra-liquid infrastructure trading project you entrusted your life savings to, custody, leverage, L2-wrapped, collapses, and now your PT-shitUSD-27AUG2025 has lost 70%. You received some airdropped governance tokens, only for the project to be abandoned months later.

While this story is exaggerated, it reflects the reality that unfolds repeatedly during a bear market when yields are compressed. Based on this, this article will attempt to provide a survival manual for the yield bear market.

People strive to adapt to the new reality, facing market crashes, they increase risk to compensate for the yield shortfall while ignoring the potential costs of these decisions.

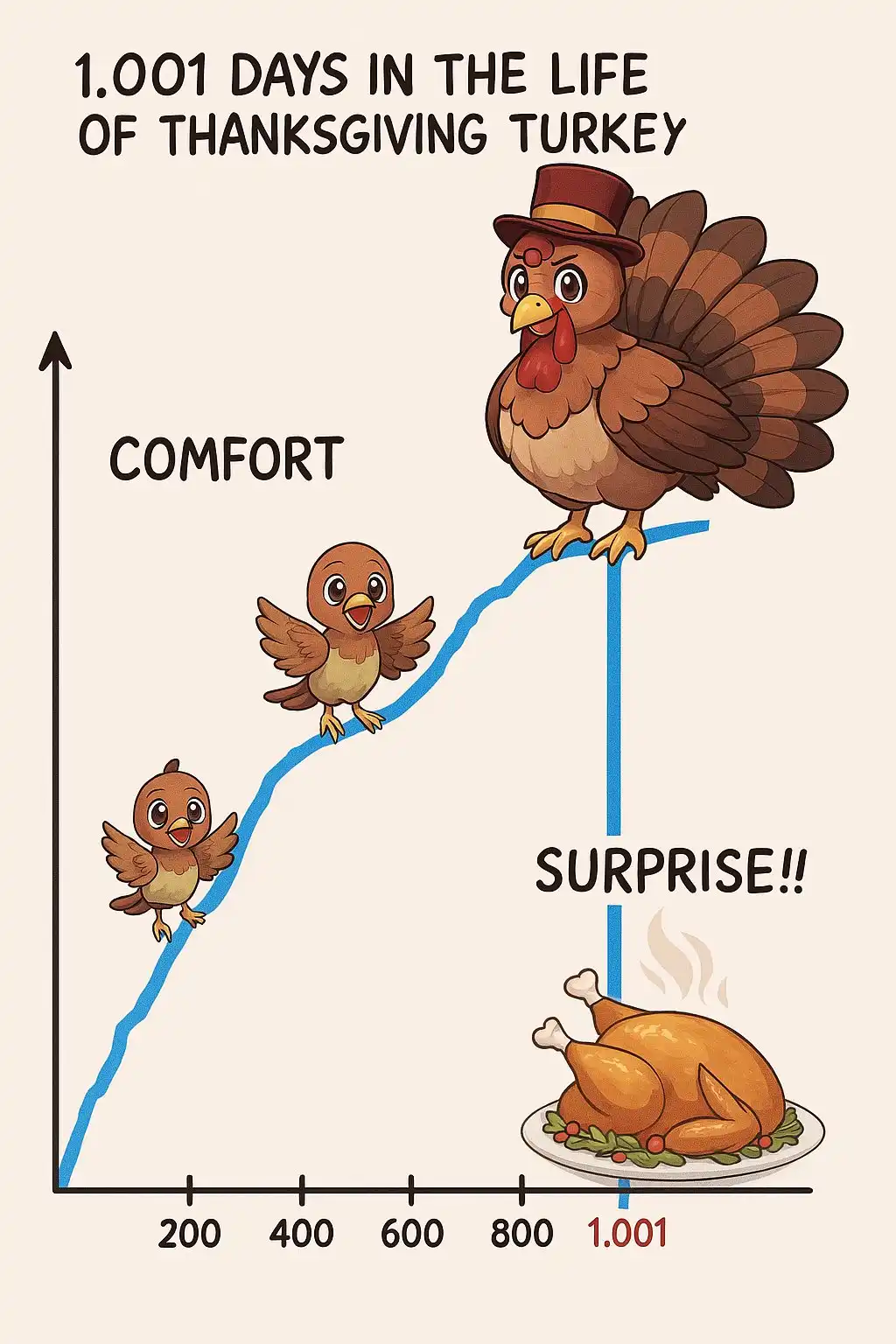

Market-neutral investors are also speculators, with their advantage lying in finding unadjusted rates. Unlike their directional trading counterparts, these speculators face only two outcomes: either making a little profit every day or losing a substantial amount in one go.

Personally, I believe that crypto market-neutral rates become severely mismatched during an uptrend, offering alpha higher than their true risk, but conversely during a downtrend, they provide returns lower than the risk-free rate (RFR) while taking on a significant amount of risk.

Clearly, sometimes you need to take risks, and sometimes you need to mitigate risks. Those who fail to see this will become someone else's "Thanksgiving dinner".

For example, at the time of writing this article, AAVE's USDC yield is 2.7%, and sUSD's yield is 4.5%.

· AAVE USDC bears 60% of the RFR while also bearing smart contract, oracle, custody, and financial risks.

· Maker, while bearing smart contract and custody risks and actively investing in higher-risk projects, bears a fee of 25 basis points above the RFR.

When analyzing the interest rate of a neutral investment in the DeFi market, you need to consider:

· Custodial risk

· Financial risk

· Smart contract risk

· Risk-free rate

You can assign an annual risk percentage to each type of risk, then add the RFR to determine the "risk-adjusted return" required for each investment opportunity. Anything above this rate is considered alpha, while anything below is not alpha.

A recent calculation found that Maker's risk-adjusted required return is 9.56% for a fair compensation.

Maker's current rate is approximately 4.5%.

Both AAVE and Maker hold Tier 2 capital (about 1% of total deposits), but even with substantial insurance, depositors should not accept yields below the RFR.

In the era of Blackroll T-bills and regulated on-chain issuers, this is the consequence of lethargy, key loss, and foolish capital.

So what should you do? It depends on your scale.

If your portfolio scale is small (less than $5 million), there are still attractive options. Check out protocols that are more secure in all chain deployments; they often provide incentives on some lesser-known chains with lower TVL or engage in basic trading on high-yield, low-liquidity perpetuals.

If you have a large amount of capital (over $20 million):

Buy short-term Treasury bills and wait for things to evolve. The favorable market conditions will eventually return. You can also look into OTC trading; many projects are still looking for TVL and are willing to significantly dilute their holders.

If you have LP, let them know, even let them exit. The on-chain treasury bond is still below the real trade. Don't let the untuned risk-return ratio cloud your judgment. Good opportunities are obvious. Keep it simple, avoid greed. You should stay here for the long term, manage your risk-return properly; if not, the market will take care of it for you.

Related Reading: Comprehensive Data Analysis: Where Did the Funds Flow Behind the $100 Billion Growth of Stablecoins? Shitcoins didn't rise, where did the money go?

You may also like

Stop Talking About Gold, Bitcoin Is Not a Safe Haven Asset

Aave Founder: What Is the Secret of the DeFi Lending Market?

The Trader's Playbook: 7 Market Cycle Lessons From LALIGA’s 90 Minutes

What do LALIGA matches teach about crypto markets? Learn how consolidation, breakouts, and late-cycle volatility shape disciplined trading decisions.

How Smart Money Tracker Survived Live AI Trading at WEEX AI Hackathon

Discover how WEEX AI Trading Hackathon tested strategies with real capital—no simulations. See how Smart Money Tracker survived flash crashes and leveraged 18x in live markets.

80% Win Rate to 40% Drawdown: An AI Trader's Brutal Recalibration at WEEX AI Wars

Dive into the technical blueprint of an AI trading system built on LLaMA reasoning and multi-agent execution. See how Quantum Quaser uses confidence thresholds & volatility filters at WEEX AI Wars, and learn the key to unlocking 95% win rate trades.

AI Trading Strategy Explained: How a Beginner Tiana Reached the WEEX AI Trading Hackathon Finals

Can AI trading really outperform human emotion? In this exclusive WEEX Hackathon finalist interview, discover how behavioral signal strategies, SOL trend setups, and disciplined AI execution secured a spot in the finals.

When AI Takes Over the 'Shopping Journey,' How Much Time Does PayPal Have Left?

Bloomberg: Aid Turkey Freeze $1 Billion Assets, Tether Remakes Compliance Boundary

Polymarket vs. Kalshi: The Full Meme War Timeline

Consensus Check: What Consensus Was Born at the 2026 First Conference?

Resigned in Less Than a Year of Taking Office, Why Did Yet Another Key Figure at the Ethereum Foundation Depart?

Russian-Ukrainian War Prediction Market Analysis Report

Ethereum Foundation Executive Director Resigns, Coinbase Rating Downgrade: What's the Overseas Crypto Community Talking About Today?

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

Stop Talking About Gold, Bitcoin Is Not a Safe Haven Asset

Aave Founder: What Is the Secret of the DeFi Lending Market?

The Trader's Playbook: 7 Market Cycle Lessons From LALIGA’s 90 Minutes

What do LALIGA matches teach about crypto markets? Learn how consolidation, breakouts, and late-cycle volatility shape disciplined trading decisions.

How Smart Money Tracker Survived Live AI Trading at WEEX AI Hackathon

Discover how WEEX AI Trading Hackathon tested strategies with real capital—no simulations. See how Smart Money Tracker survived flash crashes and leveraged 18x in live markets.

80% Win Rate to 40% Drawdown: An AI Trader's Brutal Recalibration at WEEX AI Wars

Dive into the technical blueprint of an AI trading system built on LLaMA reasoning and multi-agent execution. See how Quantum Quaser uses confidence thresholds & volatility filters at WEEX AI Wars, and learn the key to unlocking 95% win rate trades.

AI Trading Strategy Explained: How a Beginner Tiana Reached the WEEX AI Trading Hackathon Finals

Can AI trading really outperform human emotion? In this exclusive WEEX Hackathon finalist interview, discover how behavioral signal strategies, SOL trend setups, and disciplined AI execution secured a spot in the finals.