Investing Over $770 Million, Why Did Tether Invest in the Video Platform Rumble?

Original Article Title: "Why Did Tether Invest Over $775 Million in Video Platform Rumble? The Business Strategy Behind Trump's Circle"

Original Article Author: Nancy, PANews

On February 7th, the video-sharing platform Rumble announced that it had completed a $775 million strategic investment from Tether. Despite Tether, with annual profits in the billions, accelerating its investment pace over the past few months, this cross-sector investment in Rumble still came as a surprise.

The Opportunity Behind the Over $775 Million Strategic Investment

Since Rumble announced in December 2024 that it had reached a final agreement with Tether to receive a $775 million strategic investment, this investment and tender offer have officially been completed in recent days. As part of the transaction, Tether purchased 103,333,333 shares of Rumble Class A common stock at a price of $7.50 per share, totaling $775 million. Of this amount, $250 million will be used for growth initiatives, including attracting more content creators, strategic acquisitions, and enhancing the Rumble Cloud technology infrastructure.

As a video-sharing platform founded in 2013, Rumble has gained popularity among creators for advocating free speech, fairer revenue distribution, and attracting more copyright holders. It has also served as a haven against overregulation by traditional social media platforms. For example, during the 2024 U.S. presidential election, Rumble set a record with 1.79 million simultaneous online viewers, becoming a focal point for political discussions.

Regarding this investment, Rumble CEO Chris Pavlovski revealed in an interview with Barstool Sports founder Dave Portnoy that the investment will drive Rumble's global expansion, attract new creators, and redefine the meaning of a free speech platform. Pavlovski also mentioned the impact of Trump's election on Rumble's mission, believing that the collaboration with Tether will help Rumble expand globally, particularly in regions where free speech is suppressed. Integrating cryptocurrency will change how creators monetize their content, providing crypto-based tipping and payment options to further reduce reliance on centralized systems.

In addition to the reasons behind Tether's investment in Rumble, it may be related to the close ties between the two and Trump, as well as Tether's desire to expand its business presence in the United States.

Rumble has a deep relationship with former U.S. President Trump, and has even been dubbed the "Trump Concept Stock" by the outside world. As early as during the 2020 U.S. presidential election, Trump was banned from mainstream social media such as Facebook, Twitter, and YouTube. After losing his voice on social media, he began to shift to Rumble. At the same time, Trump also launched his own social platform, Truth Social, which used Rumble's video and streaming services at the time. It is worth mentioning that in addition to Trump, Narya Capital Management, the venture capital fund of former Vice President J.D. Vance, has also participated in Rumble's investment.

As Trump returns to power and a crypto-friendly policy environment in the U.S. attracts Tether's attention, Tether has made moves. In January of this year, Tether CEO Paolo Ardoino, in an interview with Bloomberg TV, pointed out that the improvement in the regulatory environment for the crypto industry, coupled with Tether's recent $775 million investment in the U.S.-listed company Rumble, has provided the company with an opportunity to reassess the U.S. market. However, he also emphasized that while not ruling out further entry into the U.S. market, it is necessary to wait for regulatory clarity and specific guidance, making the final decision based on the development of the U.S. legal framework.

Buying Bitcoin, Crypto Strategy Boosts Stock Price

Since the end of last year, Rumble has frequently appeared in the crypto field. In addition to receiving investment from Tether, Rumble has actively built up a Bitcoin reserve and launched a series of related crypto products.

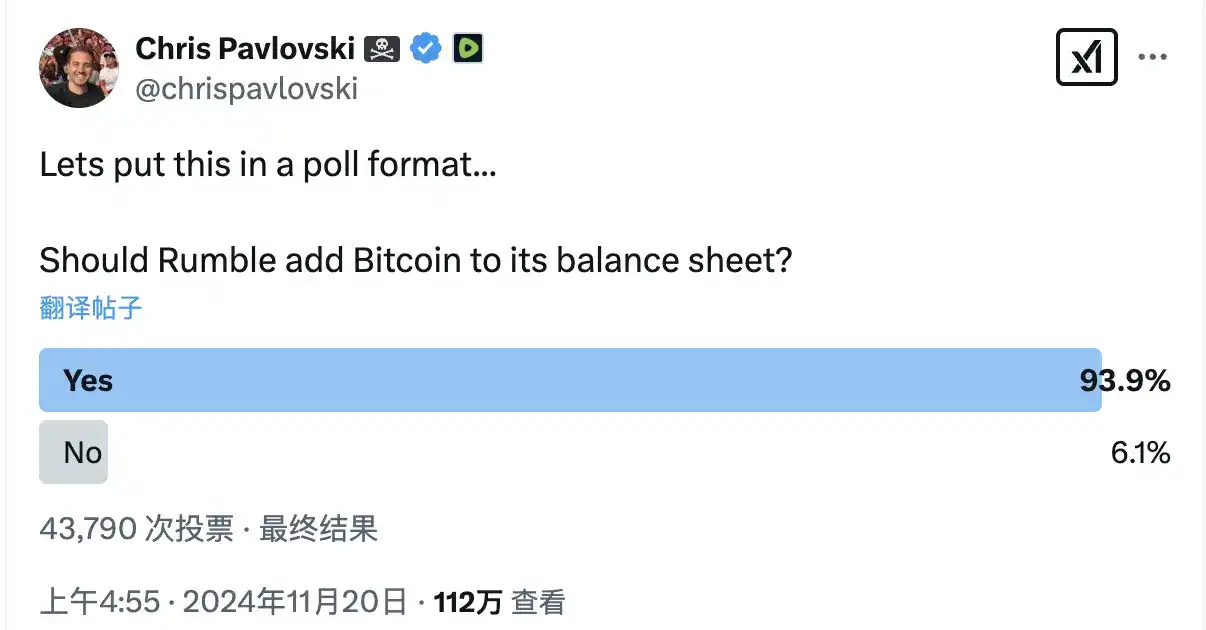

"Should Rumble add Bitcoin to its balance sheet?" In November 2024, Rumble CEO Chris Pavlovski initiated a vote on X, asking whether Bitcoin should be included in the company's balance sheet, receiving strong support.

Several days later, Rumble announced an investment of up to $20 million to purchase Bitcoin, as a key part of the company's financial diversification strategy, positioning Bitcoin as a strategic asset and inflation hedge tool.

At that time, Chris Pavlovski stated that Bitcoin is still in its early stages of adoption, and the crypto-friendly U.S. government policy and increasing institutional investor interest are accelerating this process. Unlike any government-issued currency, Bitcoin will not be diluted by endless printing, making it a valuable hedge against inflation and an excellent treasury supplement. The company plans to integrate cryptocurrency into its ecosystem, building a leading video and cloud service platform for the crypto community. Of course, Chris Pavlovski also indicated that this will not be the last time, hinting that the company may continue to increase its Bitcoin holdings in the future.

Back in January of this year, Rumble also announced the launch of the Rumble Wallet, a crypto wallet that supports Bitcoin and USDT, providing creators with a new way to transact. Creators can receive fan tips and subscription revenue in both cryptocurrencies. Paolo Ardoino, Tether's CEO, commented, "A cool feature of the Rumble Wallet is the use of an AI agent/assistant to help manage payments, suggest Bitcoin savings strategies based on past activity, and tip the most popular creators."

This series of crypto initiatives has had a positive impact on Rumble's stock price. According to Google Finance data, since Rumble announced its intention to adopt a Bitcoin treasury strategy, the company's stock price has skyrocketed, reaching a peak increase of 169.8%, briefly hitting a new all-time high of $16.27.

You may also like

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

BlackRock Buying UNI, What's the Catch?

Lost in Hong Kong

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.